Many financial advisors eventually say some version of this to me:

“I tried to work with doctors. It didn’t work.”

Sometimes it’s said with frustration.

Sometimes with resignation.

Often with a quiet conclusion: “Doctors just aren’t reachable.”

I want to challenge that story—because it’s incomplete.

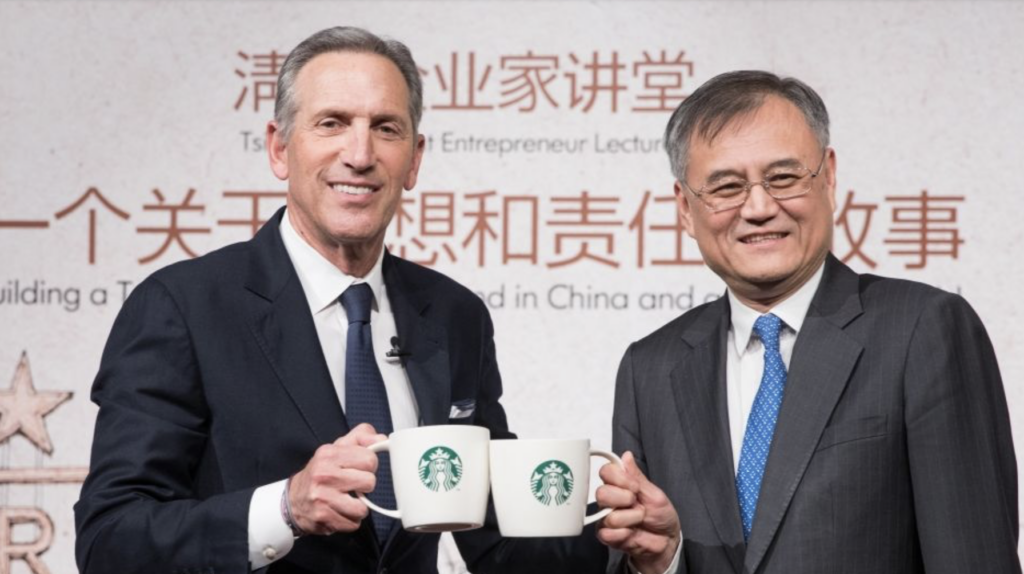

To do that, let me take you briefly outside of medicine and into the story of Howard Schultz and Starbucks’ expansion into China.

It’s a story of persistence, humility, and—most importantly—what happens when success in one culture becomes a liability in another.

Starbucks’ Success in China Was Built on Years of Failure

Today, Starbucks opens more than one store a day in China. It is one of the company’s most important growth markets.

But that success almost never happened.

In a lecture reflecting on Starbucks’ history, Howard Schultz describes how the company spent nearly nine years failing in China. Every strategy they tried—every approach that had worked in the United States—fell flat .

This wasn’t a startup struggling to find product-market fit.

This was a globally admired brand with deep resources and smart people.

And still—it didn’t work.

Why?

The Hidden Assumption That Undermined Everything

Starbucks’ early mistake wasn’t operational.

It was cultural.

Schultz explains that Starbucks initially believed its success was portable. If they simply brought their U.S. leadership, values, and operating model into China, the results would follow.

They sent experienced, trusted leaders from Seattle to run Starbucks China. These were talented executives who deeply understood Starbucks.

What they didn’t understand was China.

They lacked insight into:

- how Chinese employees related to work,

- what loyalty actually meant in that culture,

- and which values truly drove trust and engagement .

In hindsight, Schultz acknowledged that Starbucks had confused brand strength with cultural fluency.

That confusion cost them nearly a decade.

The Breakthrough Came From Paying Attention to What Didn’t Fit

Everything changed when Starbucks stopped trying to export its culture and started trying to understand the culture it was entering.

A pivotal moment occurred when Schultz attended an event hosted by Jack Ma. As he looked around the room, he noticed something unexpected: the audience included not just employees, but their parents.

At first, Schultz was confused.

Why were parents at a company event?

The explanation changed everything.

In China, he learned, work is not an individual endeavor. It is deeply embedded in family responsibility and multigenerational obligation. Employees weren’t simply working for a paycheck—they were working to support their parents and honor their family unit .

This insight reframed Starbucks’ entire understanding of what “employee engagement” meant in China.

A Single Insight Changed the Trajectory of the Company

Starbucks responded with a move that no company—American or Chinese—had ever made.

They created healthcare coverage for employees’ parents.

Not as a perk.

Not as a marketing ploy.

But as a direct response to what truly mattered to their people.

That decision transformed Starbucks’ relationship with its workforce, strengthened loyalty, and accelerated growth across China .

Importantly, this values-based decision did not undermine financial performance.

It enabled it.

Why This Story Matters for Financial Advisors

Entering the medical market is not unlike Starbucks entering China.

Many advisors approach physicians assuming that:

- high income equals financial confidence,

- intelligence equals financial clarity,

- and professional success equals openness to advice.

Those assumptions are understandable—and often wrong.

Medicine is its own culture.

Doctors are shaped by:

- years of high-stakes training where mistakes can be permanent,

- professional norms that reward certainty and punish vulnerability,

- and a deep sense of responsibility—for patients, families, teams, and institutions.

Money, for doctors, is rarely “just money.”

It is tied to:

- safety,

- identity,

- responsibility,

- and belonging.

When advisors approach doctors using strategies that worked with other professionals, the result often feels like resistance or disinterest.

But what’s actually happening is misalignment.

Why “Trying Harder” Rarely Works

Starbucks didn’t succeed in China by doubling down on what failed.

They succeeded by becoming intellectually curious—by asking what they were missing rather than assuming the market was flawed.

Howard Schultz emphasizes this point directly: growth requires the willingness to look around corners, to sit in discomfort, and to notice what others overlook .

The same is true for advisors who want to work with physicians.

The solution is not:

- louder messaging,

- more credentials,

- or more aggressive follow-up.

The solution is understanding the culture well enough that trust becomes possible.

What Engaging Doctors Actually Does

At Engaging Doctors, we help financial advisors do what Starbucks eventually did in China:

We help you stop importing a generic playbook—and start translating values.

That means understanding:

- how doctors think about money differently,

- why trust develops slowly in medicine,

- and how recommendations are earned—not asked for.

When advisors understand doctors at this level, relationships change.

Conversations deepen.

Resistance softens.

Referrals happen naturally.

Not because doctors are persuaded—but because they feel understood.

If You’ve Tried Before, This Matters Most

If you’ve attempted to enter the medical market and felt discouraged, this is the most important takeaway:

Failure is not evidence that doctors are unreachable.

It is often evidence that the culture has not yet been learned.

Starbucks failed for nine years.

That failure wasn’t the signal to quit.

It was the signal to listen more carefully.

Looking Ahead

As we move toward 2026, I’ll be sharing new ideas, frameworks, and insights designed to help financial advisors build truly physician-friendly practices—practices grounded not in tactics, but in understanding.

Thank you for being part of this community.

There is a way forward.

And it begins by learning the people you want to serve.

About the Author

Vicki Rackner, MD is a retired surgeon and founder of Engaging Doctors. She helps financial advisors attract, engage, and serve physician clients by understanding the culture of medicine—so trust can grow naturally.