I have been listening to local election-related conversations about taxes.

In 2021, the Washington State Legislature passed a law creating a tax on the sale or exchange of certain long-term capital assets. The Washington State tax-related initiative on the ballot this year would repeal an excised tax on the sale or exchange of certain long-term capital assets by individuals who have an annual capital gains of over $250K.

Those who support this initiative say that capital gains taxes represent a form of income tax, and Washington State taxpayers have rejected income taxes 11 times. Many conversations highlight Jeff Bezos’ recent move from Washington State to Florida. Mr. Bezos argues that he moved to Florida to be closer to his parents. However, others wonder if his move is a response to Washington States’ new 7% capital gains taxes in which he owes $70 million for each $1B in Amazon stock sales. Would other entrepreneurs leave Washington State in response to this tax?

Those who oppose this initiative argue that the state counts on this revenue to fund public education, school construction and childcare. Bill Gates points out that the wealth gap continues to grow, and he supports higher taxation on the wealthy.

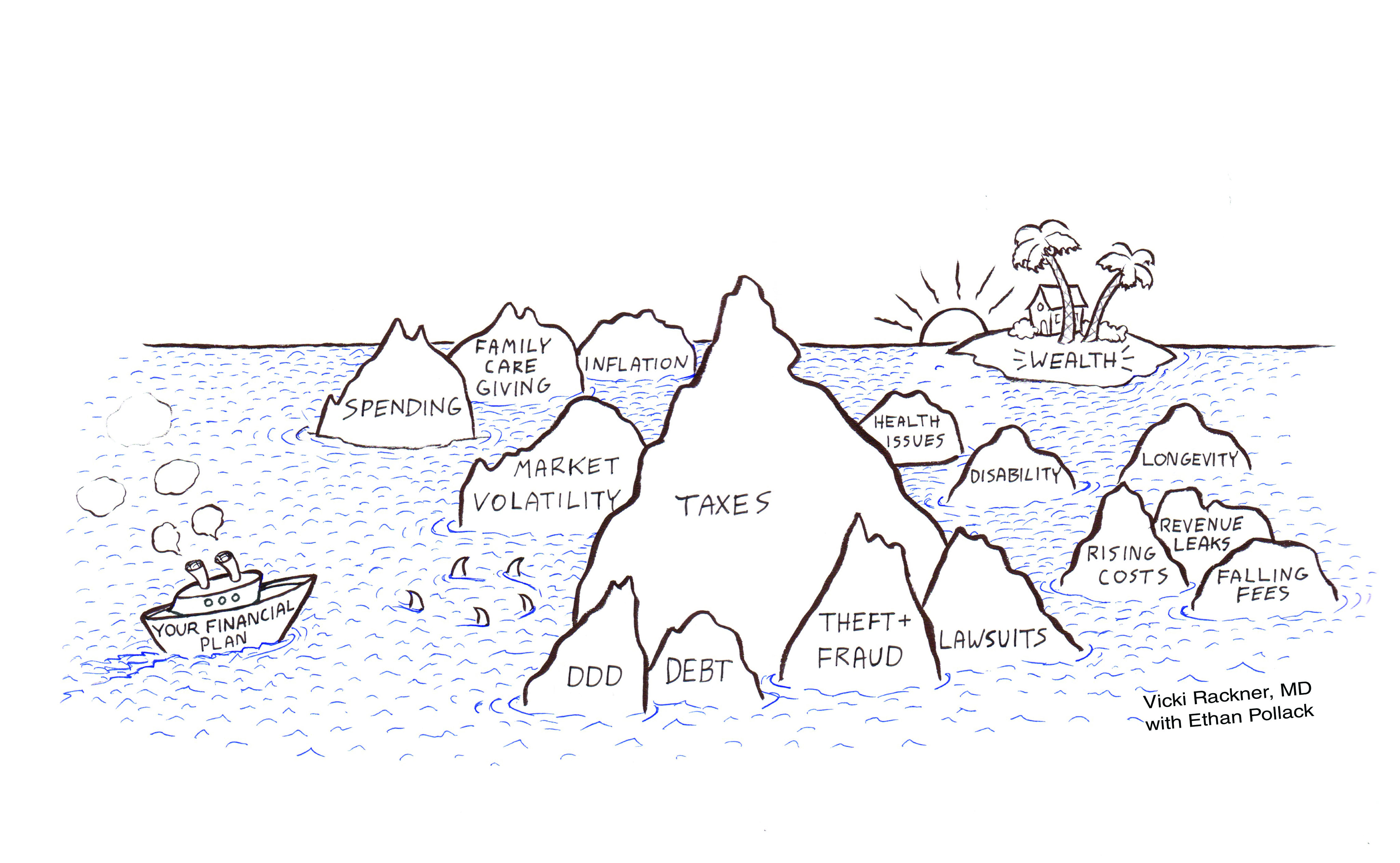

While I’m not in a position to offer an opinion, here are some things you might want to keep in mind as you and your clients have conversation about taxes.

1. Taxes represent individuals’ largest lifetime expense.

2. Over 70% of physicians believe they pay too much in taxes.

3. The tax code can be seen as a form of social engineering. Certain behaviors that help our nation build wealth are reworded with tax savings.

4. Many physicians can harvest significant tax savings by harnessing the power of the tax code. This saving can then be redeployed for wealth-building.

Judge Learned Hand, known as “the father of tax savings “ said, “There are two systems of taxation in our country: one for the informed and one for the uninformed.”

Please allow me to share more of Judge Learned Hands’ words, “Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.” Gregory v. Helvering (2d Cir. 1934) Your clients each have beliefs about their relationship with their taxes. However, please know that it’s almost always possible for your physician clients to legally and ethically lower their tax burdens.