The COVID pandemic wasn’t just a global health crisis—it was a seismic financial earthquake that fundamentally transformed how physicians think about wealth, security, and professional sustainability. Through my work with doctors at Thriving Doctors, I’ve witnessed the incredible resilience and adaptability of physicians and dentists during a time of unprecedented challenges.

Resilience, however, isn’t just about surviving. It’s about strategically positioning yourself to thrive.

The Impact of COVID on Physicians

COVID didn’t just disrupt medical practice—it catalyzed a comprehensive reimagining of medical professionals’ economic, technological, and psychological relationship with their profession. The financial consequences were particularly stark: reduced incomes, increased practice volatility, and accelerated retirement considerations created unprecedented economic pressure.

Top 10 Consequences of the COVID Pandemic on Physicians

1. Unprecedented Income Shortfalls

Before 2020, most physicians and dentists believed they had a secure income source. No doctor imagined a world where their income wouldn’t consistently grow if they remained healthy and able to work.

During pandemic lockdowns, doctors experienced significant income disruption. Elective procedures were canceled, outpatient clinics reduced capacity, and many practices faced near-total revenue shutdown. Some specialists like anesthesiologists, surgeons, and dentists saw income drops of 40-60% during peak pandemic months, creating profound financial uncertainty and stress.

2. The Burnout Crisis

Physician burnout rates have been climbing for over a decade. What was considered an epidemic a decade ago—40% of physicians reporting burnout—peaked in 2023, with over 60% of physicians experiencing burnout.

Forces beyond direct patient care—including childcare challenges, social isolation, and personal losses—contributed to this crisis. These problems cannot be resolved with simple self-care strategies like bubble baths.

3. Telemedicine and Technological Transformation

Telemedicine technology existed for years, but widespread adoption was hindered by two primary factors:

- Physicians’ belief that complete patient assessment requires in-person examination

- Uncertainty about compensation for telehealth visits

The pandemic resolved these concerns overnight, making telehealth a new standard practice.

4. A Spike in Early Retirement Considerations

A 2022 AMA survey revealed that approximately 20% of physicians considered early retirement directly due to COVID-related burnout, with specialists over 55 most likely to exit the profession prematurely.

5. Shifting Compensation Structures

Physicians transitioned from pure fee-for-service models to hybrid approaches incorporating telehealth, risk-adjusted payments, and alternative compensation frameworks. Notably, while healthcare workers were verbally praised, Medicare continued to decrease physician compensation during the pandemic.

6. Personal Risk and Trauma

Physicians experienced extraordinary personal risk, with higher COVID infection and mortality rates compared to the general population. The American Medical Association reported over 3,600 healthcare workers died during the initial pandemic waves, creating collective trauma and profound psychological impact.

7. Educational and Training Disruptions

Medical education underwent dramatic transformations. Residency programs were disrupted, clinical rotations modified, and training models fundamentally redesigned, creating long-term consequences for medical education pipelines.

8. Practice Economics Restructuring

Small and medium medical practices faced existential financial challenges. Many were forced to take significant loans, reduce staff, or merge with larger healthcare systems. Notably, Private Equity has purchased 44,000 medical practices—now owning more practices than hospitals.

9. Interest in Multiple Revenue Streams

The pandemic fundamentally altered physicians’ career and income expectations. Many began exploring alternative paths, including:

- Healthcare technology

- Consulting

- Medical leadership roles

- Non-clinical medical careers

- Real estate investments

- Entrepreneurial ventures

10. Social Engagement Transformation

Physicians and dentists shifted their professional networking from traditional spaces like hospital lounges to digital platforms, particularly private social media groups. They began leveraging social platforms not just for connection, but for patient acquisition and professional development.

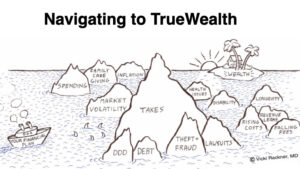

How Financial Advisors Can Contribute to Doctors’ COVID Catch Up

For most physicians, financial advice often feels generic and disconnected from the unique realities of their lives. They have invested decades mastering complex medical skills, working grueling hours, and managing high-stakes patient care. Their financial strategy needs to be equally sophisticated, personalized, and forward-thinking.

However, you have a unique opportunity to deliver value by helping doctors in their efforts to get caught up after all the COVID changes

Here are 5 ways you can deliver value to doctor prospects and clients.

1. Strategic Tax Planning

Help physicians understand that taxes represent their lifetime’s number one expense. The tax code rewards behaviors that build national wealth—like job creation, housing development, and supporting vulnerable populations.

While almost half of physicians do their own taxes using software, the top 1% hire tax strategists to navigate the 70,000-page tax code and legally minimize their tax burden.

2. Maximize Compensation Opportunities

Many doctors do not effectively negotiate their compensation packages. Financial advisors can:

- Prepare physicians for annual performance reviews

- Help demonstrate additional value for salary negotiations

- Explore strategies like outsourcing medical billing to improve cash flow for doctors in private practice

3. Sophisticated Investment Vetting

As accredited investors, physicians are frequently pitched investment opportunities. Help them move beyond emotional decision-making by providing rigorous financial analysis.

4. Develop Multiple Revenue Streams

Encourage physicians to explore income diversification beyond clinical practice, such as:

- Medical litigation expertise

- Online course creation

- Professional speaking

- Writing and publishing

5. Transform Money Mindsets

Leverage insights from behavioral economics to help doctors understand that wealth-building is approximately:

- 80% mental management

- 20% financial management

Address potential shame or embarrassment about past financial choices by sharing transformative success stories.

An Unprecedented Opportunity for Financial Advisors

At a time when physicians face extraordinary challenges, financial advisors have an unprecedented opportunity to attract, engage, and serve this critical professional community.

The key is understanding their unique journey and providing truly personalized, forward-thinking financial strategies.